The way asset management firms raise capital has evolved significantly, transitioning from traditional practices that served well for decades to a digital-first approach. This shift is driven by fundamental changes in market structures and modified advisor behavior that has uprooted how firms once operated and grew AUM.

Digital transformation has become a driving force, with technological advancements enabling real-time data analytics to redefine advisor prospecting and engagement. This evolution marks a distinct departure from the once-essential networking/relationship-driven wholesaling model to a data-informed prospecting approach. Interestingly, wholesalers remain as vital as ever to the sales process. They are simply better equipped to engage advisor prospects the way they now prefer to interact.

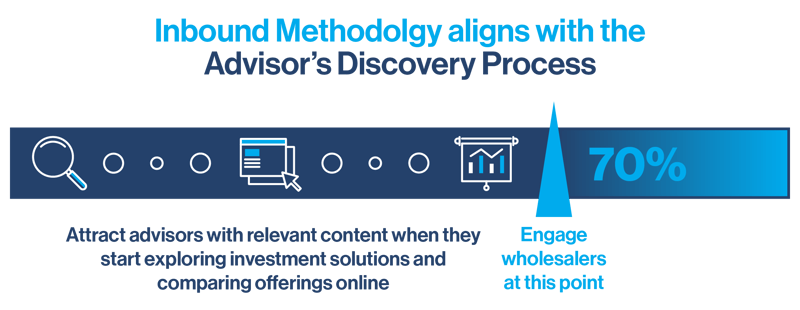

Inbound Methodology: Aligning with Modern Behavior

The Inbound methodology aligns with this transformation by attracting advisors with relevant content when they start exploring investment solutions and comparing offerings online, often not engaging with wholesalers until they are 70% or more of the way through their discovery process.

The Wholesalers Challenge

In recent years, most wholesalers have found it increasingly difficult to secure face-to-face meetings with advisors, a reflection of a growing trend among advisors to reduce wholesaler interactions. Now the challenge has morphed into capturing advisors' attention online. This reality makes digital content a crucial tool for creating awareness and engagement. It's about adapting to the way advisors prefer to interact with asset management firms. And this begins with knowing exactly who your target advisor audience is so that you can reach them digitally with content that is relevant and timely to their needs. . This new model is often referred to as the “wholesaler funnel.”

Buyer Personas

Identifying your target audience begins with creating detailed profiles of your ideal advisor clients – your buyer personas- and understanding their needs, challenges, motivations, and goals. By recognizing their motivations you can develop content that connects with advisors at each stage of their buyer's journey.

It’s vital to know, however, that as much as an asset management firm would like to offer content about its own investment solutions, content in the early stages of online engagement should squarely answer the questions advisors are posing in search queries. Building awareness is about building credibility, and this is not the time to promote individual products and investment solutions.

The Awareness Phase

The first phase of digitally engaging advisors using Inbound starts with understanding what they are searching for online and providing a consistent stream of quality content that addresses their questions and needs. The more accurately the asset manager understands the terms and language advisors are using when they search, the more targeted their content will be in providing possible solutions.

Once a comprehensive content strategy and content resources have been created, the asset manager can consistently deploy that content across multiple digital platforms to meet their ideal prospects where they are spending their time digitally.

Conclusion

Many asset management firms find this transitionary process daunting and opt to continue using traditional wholesaling models to raise capital. But firms that can meet prospects online where their research begins and provide meaningful educational content to help them define their problem and guide them toward possible solutions are positioned to outpace competitors who haven't embraced a digital-first approach to distribution.

Topics: Content Digital Marketing Digital Distribution Asset Management Website Sales Enablement CRM Automation Lead Generation Technology

.png)